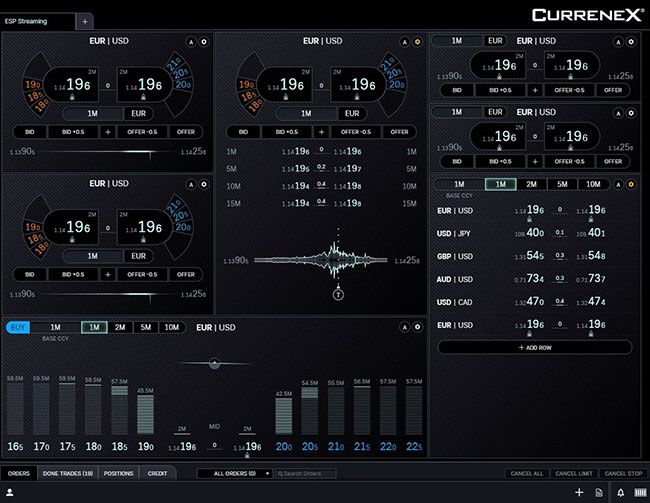

Executable Streaming Prices (ESP)

Executable Streaming Prices are available for FX Spot and Precious Metals Spot via our ESP execution functionality. Key benefits of this execution method include:

- A real marketplace with hundreds of market participants and diverse liquidity sources

- Ability for participants to be passive or aggressive, earn spread or pay spread, which facilitates continuous markets and price discovery

- Precision pricing in each currency pair

- Ability to aggregate and configure multiple liquidity streams based on preferences and relationships, to create private liquidity pools that are unique to each client’s trading needs and style

- Wide range of order types e.g simple, complex or algorithmic, to empower clients to customise how they express risk

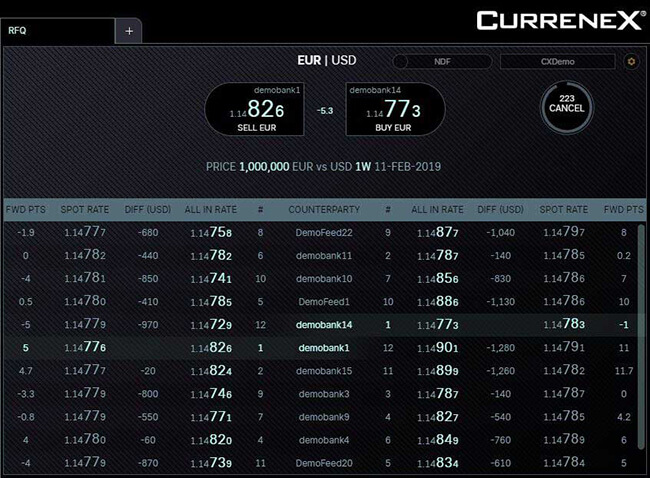

Request for Stream/Request for Quote (RFS/RFQ)

The key benefits of this method of execution include:

- No limit on the number of banks or liquidity providers for each price request

- No minimum amount required to trade; odd lots and broken dates permitted

- A real-time comparison between the best price and all other prices

- Capturing all price quotes at time of execution allows for analysis of price providers

- Trade history to facilitate your transaction cost analysis (TCA) and audit trail

- STP, workflow solutions and trade history complete the offering